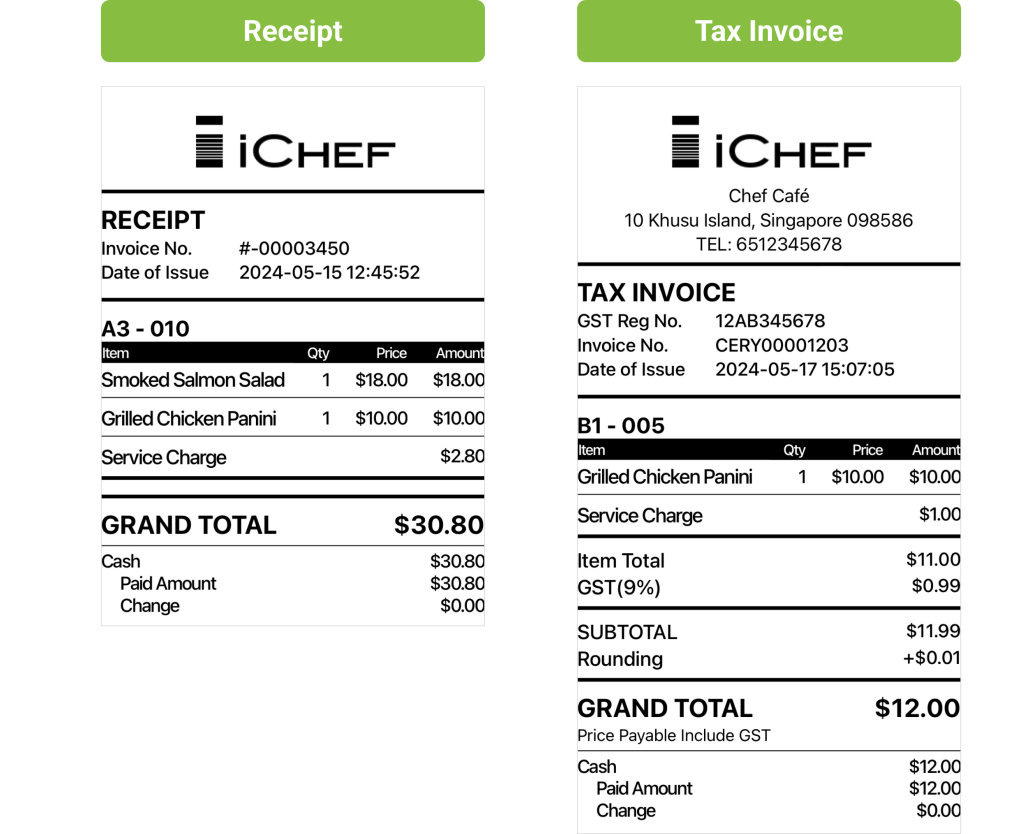

Based on your GST settings, iCHEF POS will issue either an invoice or a receipt upon checkout completion.

- Non-GST Registered: a receipt

- GST Registered: a GST tax invoice

- Learn more about: GST Settings

Receipts

Receipt is a proof of payment made by customers. It will list all the purchased items and payment details. If you are not GST-registered, a receipt will be printed out after checkout. You can configure the printing settings on iCHEF backend.

GST Invoice

A tax invoice is the main document for supporting an input tax claim. It must be issued when your customer is GST registered.

A GST-registered store can issue tax invoice directly via iCHEF POS.

Round The Bill

When calculating total amount payable, iCHEF POS will round the total to the nearest 5 cents to facilitate cash payment.